FX Market Report - 13/07/20

Patrick French

US dollar retreats amid ongoing pandemic concerns

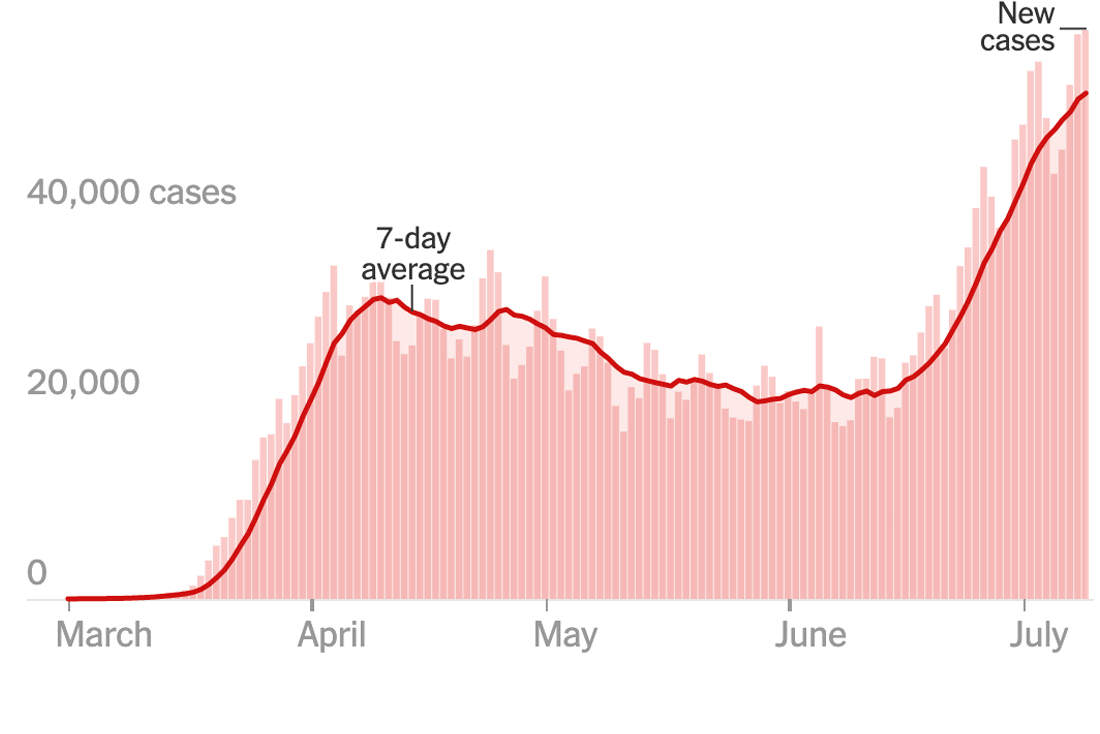

It seems that the worsening pandemic numbers in the US are starting to take their toll on the greenback. With new cases hitting record highs almost daily, and deaths starting to tick upwards, the dollar fell against every other G10 currency last week, save the Canadian dollar. Economic data in the US is still generally strong, but most indicators that are released do not yet reflect the impact of the new closings in response to the surge in cases. Emerging market currencies are also beginning to reflect the relative performance of different countries in coming to grips with the pandemic. The Brazilian real and the Mexican peso were the worst-performing major currencies of the week, while the Chilean peso and the Chinese yuan ended up near the top of the rankings.

This week, the focus will squarely on the COVID figures out of the US and the European Union summit later in the week (Friday-Saturday). As new cases in the US continue to print daily records while deaths and hospital utilisation play catch up, we think that a likely positive outcome of the EU summit could well energise the euro.

GBP

Sterling had a good week, in spite of the lack of any visible progress in the Brexit negotiations. The credit for the rally probably goes to positive noises about a more

generous fiscal stance in the Chancellor's mini-budget last Wednesday.

This week is data rich in the UK, with releases on GDP (Tuesday), inflation (Wednesday) and the labour market (Thursday). There is scope for the rebound in all of these to surprise to the upside, in line with recent data elsewhere, so we expect the pound to follow the euro higher against the US dollar. Aside from that, investors will continue to pay close attention

to the latest virus numbers for any signs that the recent easing in lockdown measures is having an impact on pushing up infections.

EUR

There was little data out of the Eurozone last week, but the euro was generally well supported by optimism about the approval of the EU recovery fund. Angela Merkel seems to be resolved to overcome opposition from the so-called ‘Frugal Four’ (Austria, Denmark, the Netherlands and Sweden) and get the plan approved no later than the European Union summit this week.

The ECB meeting on Thursday is unlikely to see any significant changes in the central bank's extremely easy monetary policy. President Lagarde is likely to instead use this week’s meeting as an opportunity to again pressure European authorities to do more to support the bloc’s economy. That being said, we expect a positive outcome from the EU summit to keep the common currency well supported against the US dollar.

USD

The dichotomy between dismal daily COVID data in the US and comparatively stronger economic data in the US has yet to resolve itself. We are slightly less positive than we were last week. Daily new cases continue to hit record highs. The one silver lining we noted last week is fading, as daily deaths start to climb and catch up with the former. On the positive side we still see positive surprises in economic numbers. Last week it was the jump in ISM non-manufacturing PMI (the rough equivalent of the European PMIs) and a decent drop in weekly jobless claims. However, neither of those reflect yet the reintroduction of lockdown measures over the last few days.

This week we think inflation numbers will be more important than the market does. So far, supply disruptions have not resulted in any inflationary pressures, in spite of the successful income-supporting measures enacted by the Federal government. It will be interesting to see whether that's still the case four months into the pandemic.

CHF

Similar to the week before, the Swiss franc ended last week little changed against the euro. Since late-June, the pair has remained within a very narrow band of 1.06-1.07, recently trading within an even tighter range. Last week’s labour market data from Switzerland surprised to the upside. On a non-seasonally adjusted basis, the rate came in at 3.2% in June, lower than the previous month’s 3.4%. The data, however, did not have a strong influence on the exchange rate. The franc seems to continue being driven largely by shifts in sentiment - or the lack of it.

Aside from SNB president Thomas Jordan’s speech on Tuesday, this week is mostly empty in terms of important news from Switzerland. Outside news has a greater potential to provide volatility in the EUR/CHF rate than domestic information, in our view.

AUD

AUD spent much of last week relatively range bound against the US dollar - a good gauge of the lack of clear direction in market sentiment as investors are caught between rising virus cases and improving economic data.

So far, an increase in virus numbers in Australia, and the reintroduction of lockdown measures in areas such as Melbourne, have not yet translated into a weaker Aussie dollar. New daily cases of the virus in Australia rose to its highest level since late-March last week, up from single figures to around 300 within the space of a month. The majority of these cases have been recorded in the state of Victoria, which has now imposed stricter measures on travel and a six-week lockdown on Melbourne. The lack of reaction in the currency may be due to the low death rate, with only six COVID related deaths recorded in the country since late-May.

Meanwhile, the RBA kept interest rates unchanged last week, with governor Lowe again noting the improvements witnessed in domestic data. We’re likely to get further evidence of this pick-up in activity on Thursday, with the release of the monthly labour report for June.

CAD

The underperformance of the Canadian dollar last week was fairly remarkably considering the impressive data we’re continuing to see out of the Canadian economy. Canada's Ivey PMI for June massively exceeded expectations, rising to an expansionary 58.2 from the previous month’s 39.1. Housing starts for June also rose more-than-expected, while Friday’s labour report showed that the Canadian economy added almost a million net jobs last month. A record 953,000 net jobs were created in June, meaning that around 40% of those jobs lost since the onset of the crisis have now been recovered - a quicker pace than originally anticipated. These improvements in economic news have, however, been largely overlooked by currency traders, with the moves witnessed in the currency last week driven largely by technical factors.

This Wednesday’s Bank of Canada meeting is almost sure to have more of an impact on the currency. While no change in policy is expected, investors will be eagerly awaiting the BoC’s comments on the state of the Canadian economy, particularly its updated economic projections.

CNY

The yuan broke through the physiological level of 7 to the US dollar early last week, the first time it has done so since the height of the market panic in mid-March.

We mentioned last week that optimism surrounding a recovery in the Chinese economy has been behind much of the recent strength in the yuan. While that certainly continued to support CNY last week, the move higher in the currency was triggered largely by the sharp move higher witnessed in Chinese equity markets. The Shanghai Composite index jumped over 10% last week, due to a combination of technical factors and an easing in the number of COVID cases in China. This is a development that tends to attract foreign investors, hence the rally witnessed in the yuan last week.

Investors will have a host of economic data releases out of China to digest this week. Among the most noteworthy, and potentially market moving, will be Tuesday’s trade data and Thursday’s retail sales figures for June. We will, however, be paying closest attention to the initial GDP estimate for the second quarter, also due on Thursday. Following a record 9.8% contraction in Q1, the market is pencilling in a record expansion in excess of 10% for

the three months to June. Confirmation of this would be evidence that the Chinese economy is bouncing back strongly from the COVID-induced downturn and could help lift investor sentiment this week.

Please Like, Comment & Share if you found this article insightful.

Berkshire FX Blog

The ‘Santa Claus’ rally did not disappoint traders and investors as global indices climbed higher to end 2023.

Most notable were the ‘DOW Jones’ (up over 13% for the year) & ‘S&P 500’ (up over 23% for the year) as the US continued to outperform the rest of the world; with the former hitting all-time highs and the latter not far behind achieving the same goal. Latin American and European markets were also up, however, the somewhat surprising exception was Asian markets, which continued to weaken into the back-end of the year. Expectations were high at the beginning of the year as China put an end to their zero-covid restrictions and economists forecasted a resurgence in economic activity which never quite transpired.

There were two key narratives driving FX markets last week; at the beginning of the week the main focus was a spike in US government bond yields whilst the end of the week was dominated by the blow-out Non-Farm Payrolls jobs data.

A recent sell-off of US government bonds has led to yields hitting multi-year highs. As investors dump bonds, supply and demand forces dictate that yields increase to entice new investors, however, this comes at the expense of making government borrowing more expensive and ultimately increases the risk of a government default at some stage in the future. There are several potential reasons for the sell-off, most notably; asset managers may be overweight in bonds and need to rebalance their portfolios; there is an oversupply of bonds in the market; rising oil prices or simply the fact that investors are starting to come to terms with the idea that central banks will maintain high rates for a long time.

Sterling continued to suffer verses its major peers last week following weaker than expected GDP data. UK GDP growth contracted by -0.5% MoM in July which was a downside surprise compared with the forecasted -0.2%. Whilst low growth may help the case for a drop in inflation, it likely unsettled investors and traders who decided to steer clear of long Pound positions. We may see further flight from Sterling this week should Wednesday’s CPI data surprise to the downside as this may influence Thursday’s BoE interest rate decision. A pause/failure to hike would likely be perceived as dovish by market participants and indicate the central bank is near its terminal rate.

The US dollar has been on an 8-week winning streak as investors and traders re-allocate funds into the safe-haven currency amid on-going concerns of a slowdown in China. The greenback rose to a 6-month high verses its major peers recently, following a collapse in China Services PMI to its lowest level since the end of zero-covid restrictions.

Sterling Rising Covid-19 case numbers, a stronger Dollar, Brexit back in the headlines and a bi-election loss for the government are all weakening Sterling this morning with little sign of an immediate recovery before Thursday’s Bank of England meeting. Market expectations for the path of interest rates in the United Kingdom suggest a rate rise in August of next year, well ahead of the Federal Reserve and European Central Bank. Confirmation of those thoughts will help Sterling in the short term but there remains a risk that the Pound finds itself below the 1.37 mark against the USD over the course of this week given Brexit headlines and the rise in the delta variant. Euro As noted on Friday, the European Central Bank will be more than happy with the path of EUR/USD over the past 4 days. ECB President Lagarde speaks this afternoon at 15.15 BST to the European Parliament and is expected to continue making the difference clear between the US and European economies clear. A push to the 1.17s in EUR/USD this week is not out of the question. US Dollar The USD has continued to strengthen over the weekend following further comments from Fed officials that the discussion on tapering stimulus was now formally open. We are now in an uncertain period of whether the Fed really wants to run the economy hot or has already given itself a scare with inflation pressures rising. In this circumstance it seems pretty obvious that comments from Fed members will be closely watched with two making comments on the state of the US economy at 14.45 BST this afternoon. Fed Chair Powell speaks to Congress tomorrow and would represent the first opportunity for him to clarify his comments should the market reaction be predicated on false hope. Elsewhere The safe havens of the Yen, Swiss Franc, Dollar and the Euro to a certain extent are all higher this morning thanks to sell-offs in Asian markets overnight and without much guidance from the US given it’s a public holiday. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.

The Dollar rallied late in the week against its G10 peers, only to give up most of those gains after a mildly disappointing payrolls report on Friday. The jobs data is still hard to interpret, but other measures of world growth continue to show signs of strength and inflationary pressures are not letting up. Most emerging market currencies managed to end the week higher, as commodity prices continue to rise. The Brazilian Real was the undisputed winner among the majors, with the New Zealand Dollar the worst performer. Two events will dominate traders attention this week, both on Thursday, starting with the June meeting of the ECB. While no change in monetary policy settings is expected by us or the market, there is the potential for a slightly less dovish set of communications than the market is expecting, which could provide a boost to the common currency. As the meeting happens, we will receive the May inflation report from the US, so Thursday afternoon promises to be a volatile time for trading. GBP The strength in the PMIs of business activity for May and recent less-than-dovish comments from Bank of England policymakers raise the prospects that the UK may actually lead both the Federal Reserve and the ECB in hiking rates. We think this possibility is behind much of the recent strength in the Pound, and recent economic data continues to support that thesis, particularly last week’s services PMI that rose to its highest level on record. There are no market-moving releases this week that will add much information to the current picture, so expect Sterling to trade off events elsewhere, notably the ECB meeting on Thursday. EUR The May flash inflation report out of the Eurozone made it clear that it is not exempt from the inflationary pressures that are building up worldwide. The headline rate finally broke above the 2% level for the first time since 2018. The core rate rose more modestly to 0.9% and is still below the ECB’s target. We think there is plenty of room for upside surprises here in the coming months. The key to the ECB meeting this week will be whether the "significantly" higher rate of bond purchases announced in May is scaled back in view of the strengthening economy. We think the ECB is not quite ready to take that step, though the staff forecasts will certainly reflect a more optimistic outlook. Overall, we expect the Euro to drift higher, though more as a result of general Dollar weakness than specific Euro strength. USD The US payrolls data for May provided further confirmation that supply constraints are becoming the bottleneck to US growth, and that excess demand will continue to put upward pressure on prices. The headline number of 559k jobs looked healthy enough, but it fell short of consensus, and the labour force participation rate stagnated. Wages rose more-than-expected, in another sign that employers are competing harder to fill positions. We think that generous unemployment benefits, closed schools and worker relocation during the pandemic will continue to constrain hiring and thus booming demand will result in increased inflationary pressures over the next year at least. If the Federal Reserve fails to respond, as seems likely, we do not think this will be positive for the Dollar. CHF The Swiss Franc ended last week around the middle of the pack of G10 currencies in the performance tracker, while the EUR/CHF rate edged down closer to the 1.09 level. The Franc appears to have been boosted by a decline in US yields in the second half of the week. Last week’s economic data from Switzerland was mixed, but overall continues to point to a recovering economy. Particularly welcome was a decline in unemployment, which should make room for a rebound in internal demand as the country eases COVID-19 restrictions. This week’s calendar for Switzerland is quite light. The key inflation data print is already behind us, with consumer price growth surprising slightly to the upside, which fits into the picture of inflation rebounds elsewhere in Europe and across the pond. AUD Last week was a very volatile one for the Australian Dollar, although this was driven almost entirely by outside forces. The currency fell sharply versus the broadly stronger USD on Thursday morning, breaking out of its recent range that it has occupied since mid-May, before rallying after the US payrolls report to end the week only modestly lower. Aside from last Tuesday’s RBA statement, which delivered another dovish assessment on rates, there wasn’t too much news to write home about. The Q1 GDP data was modestly stronger-than-expected. Growth of 1.1% quarter-on-quarter returned in the first three months of the year (above the 0.6% estimate), although the considerable lag in the data meant that it was largely overlooked. The more timely trade data for April was, however, encouraging with exports increasing by 3% month-on-month. An upgrading of Australia’s rating outlook to ‘stable’ from ‘negative’ by S&P on Friday is also a welcome development, although again we’ve not seen too much reaction to the news from investors. With few data releases scheduled for Australia this week, we think that AUD could once again be driven by external developments. CAD CAD ended trading last week around the middle of the G10 performance tracker, edging modestly lower versus the US Dollar. Friday’s Canadian labour report was a disappointment, partly offsetting some of the upside from a similarly underwhelming jobs report in the US. A net 68,000 jobs were shed in Canada in May as the COVID-19 lockdowns dragged on for yet another month. The jobless rate also ticked higher to 8.2%, although this would have been considerably higher (almost 11%) had it included those discouraged workers that dropped out of the labour force. Yet, with vaccinations now taking place at a very swift pace in Canada, we are hopeful that this trend will be reversed in the coming months. The Bank of Canada will take centre stage on Wednesday when the latest policy decision is announced. We expect no change this week, although think that the BoC could tee up an additional unwinding in stimulus measures in the third quarter, which may provide some upside for CAD in the second half of the week. CNY A surprise to the downside in this morning’s trade data has not had too much of an impact on the Yuan, which edged lower last week to around the 6.40 level versus the Dollar. Export and import growth fell short of expectations, although still grew handsomely on this time last year. Total exports grew by 27.9% year-on-year in May, well short of the 41.6% pencilled in by the market. This suggests that global demand may not be holding up quite as well as hoped and provides a slight cause for concern for market participants. Chinese inflation data for Wednesday will be closely watched by the market. We expect to see ongoing signs that prices globally are increasing at a steady clip and a surprise to the upside in this week’s data cannot be ruled out. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.

The key financial market themes of the last six months were replayed last week. Commodities bounced back strongly, inflation data out of the US surprised to the upside, and risk assets rallied, with commodity-sensitive emerging market currencies taking the lead. Rates in G10 countries are still in a holding pattern, but we think it is only a matter of time before they resume their march higher amid stronger than expected economic recoveries elsewhere and relentless pressure on supply chains and ultimately prices. In keeping with these themes, the Brazilian Real, the Chilean Peso and the New Zealand Dollar were the winners last week, and the safe-haven Japanese Yen was unsurprisingly the worst performer. This trading week is shortened by the London and New York Monday holidays, but will nevertheless be rich in data. Inflation data in the Eurozone for May comes out Tuesday, and will show the extent to which inflationary pressures there follow the US upward path with a lag. Later on Tuesday, the US ISM index will be released, and there will be special focus on the prices paid component. Finally, Friday we will get the latest read on the state of the US jobs market via the payrolls report for May, where booming demand is expected to run into labour market frictions leaving the numbers subject to an unusual amount of uncertainty. GBP A booming recovery led by the manufacturing sector, as reflected by the PMI indices of activity, and hawkish noises from the Bank of England propelled Sterling to second place in last week’s G10 FX performance tracker. While we think that the Pound rally may take a short-term breather, especially given the lack of market-moving news this week, we think the Bank of England may lead the Federal Reserve and the European Central Bank in the process of withdrawing monetary stimulus from the economy, which can only be a positive for the currency. The shortened UK trading week is relatively light on economic data, aside from revised PMI numbers. Investors will, however, have comments to digest from Bank of England governor Andrew Bailey on Thursday. EUR Some dovish comments from ECB council members have stopped the Euro rally, for now. While markets remain focused on the ECB meeting on 10th June, we think this week's preliminary inflation data for May will receive more than the usual amount of attention. An increase to precisely the ECB target of just below 2% in the headline number is already priced in, as is a more modest jump in the core subindex that excludes volatile food and energy components, to a level still below target in the latter. However, strategists have recently lagged in adjusting upwards their estimates of inflation worldwide, so we think there is room for a positive surprise that would buoy the common currency. USD Another week, another upward surprise in inflation data out of the US. Last week it was both the first quarter GDP deflator and the more timely personal consumption expenditures (PCE) deflator, which is the preferred inflation metric of the Federal Reserve. The latter jumped #to 3.6% year-on-year, its highest level since September 2008. Bond markets are taking this in stride for now, and the 10 year Treasury yield ended the week not far from where it had begun. CHF The Swiss Franc was one of the worst performers in G10 and ended last week somewhat lower against the euro, despite a decline in US yields. Recent changes in sight deposits indicate continuing interventions from the SNB, but their intensity appears to wane. CFTC positioning data continues to point out to a slightly bearish attitude of speculators towards the franc. We think there’s plenty of room for it to turn more negative in the coming quarters, which should put some pressure on the Franc. Nevertheless, most recent Covid and forward-looking economic data from Switzerland is mostly positive, which has helped the Franc to outperform its Japanese counterpart. The KOF leading indicator, which serves as a barometer for future economic growth, jumped to 143.2 in May, a record high. AUD The Reserve Bank of Australia struck another dovish tone during its monetary policy assessment overnight. As expected, rates were kept unchanged at historic low levels. Governor Lowe noted that the recovery in the economy had been faster than expected, highlighting an improvement in the housing market and an increase in borrowing. Unlike its New Zealand counterpart, which hinted at hikes in the second half of next year, the RBA reiterated again that rate hikes were unlikely until at least 2024, despite the improvement in economic conditions. It also warned over the risk of increased rates of virus contagion, such as that currently gripping the state of Victoria. Investors largely took today’s RBA announcement in its stride. We could, however, see heightened volatility during the rest of the week, with a host of data releases on the docket. We will be paying close attention to tomorrow’s GDP and Thursday’s retail sales data. CAD With little to no economic news out of Canada last week, the USD/CAD cross was stuck in a relatively narrow range around the 1.20-1.21 mark, just shy of the currency’s strongest position in six years. The Canadian Dollar has been well supported by the rally in commodity prices and, more lately, the much better progress being made on the vaccination front. Canada has now administered at least one vaccine dose to more than 56% of the population, more than the US and just behind the UK as the most out of any major nation. The pace of daily vaccinations in Canada has been quite extraordinary in recent weeks, with the country now administered vaccines at more than double the pace of the US (0.92 doses per 100 vs. 0.39). Volatility in CAD is expected to pick up in the coming days, with a number of macroeconomic data releases on tap. Q1 GDP data out later today is expected to show solid growth of 6.7% annualised. Investors may, however, pay closer attention to Friday’s more timely labour report for May. CNY The Yuan has continued to go from strength to strength in recent weeks and is now trading around its highest position versus the dollar in over three years - just below the 6.38 level at the time of writing. Sentiment towards CNY, and risk assets in general, has been elevated of late, so much so that investors appeared unflustered by the decision of the People’s Bank of China to raise the FX reserve requirement ratio for financial institutions on Monday. The ratio was increased for the first time in 14 years from 5% to 7% in what appears to be an attempt to lessen appreciating pressure on the Yuan. The move was, however, widely expected, and we’ve not seen too much movement in the exchange rate as a result. This Thursday’s services PMI from Caixin will be closely watched by currency traders. If last week’s non-manufacturing PMI from NBS is anything to go by, we could be in for another upside surprise, which may provide further support for CNY in the back end of this week. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.

This week has been a rather bizarre one in the FX market, particularly when it comes to movements in the US Dollar. The greenback had been on the back foot for the first three days of the week and looked certain to end it lower after a number of Federal Reserve policymakers suggested that a tightening in monetary policy in the US looked a long way off. However, the Dollar has seen its fortunes reverse in the past couple of trading sessions, primarily following comments from FOMC member Randal Quarles. Speaking at an event late on Wednesday, Quarles said that he thought it was time that the Federal Reserve begin discussions on ending the bank’s emergency stimulus support in light of rising inflation. A combination of an unleashing of pent-up demand and mounting supply shortages has sent inflation higher across the board in recent weeks, particularly in the US. The real question on inventors minds is now centered around whether this uptrend in prices will persist, and how central banks around the world will respond. We tend to agree that upward pressure on prices will abate once supply catches up with booming demand. We do, however, also contest that Fed policymakers are perhaps slightly too calm and relaxed about the situation and are taking a backward looking approach, rather than a forward facing one that takes into consideration the massive shift in macroeconomic conditions. Indeed, a number of other major and emerging market central banks have already either indicated that a tightening in policy is on the cards, or already removed some of their accommodative policies in light of rising prices. The Bank of Canada, for instance, became the first G10 central bank to announce a tapering of its QE programme in April. The Reserve Bank of New Zealand also struck a hawkish tone during its May meeting, saying that it expects to hike rates in the second half of 2022, much sooner than previously anticipated. Wednesday’s comments from Quarles is the first real sign that the Fed may perhaps be close to following in similar footsteps. Sterling jumps after BoE’s Vlieghe talks up 2022 rate hike Data out on Friday is expected to provide further evidence of the surge in prices currently being experienced in the US. The Fed’s preferred measure of inflation, the core PCE index, is expected to rise to almost 3% year-on-year in April. Durable goods orders and initial jobless claims beat expectations yesterday, the latter falling to 406k in the week to 21st May - its lowest level in fourteen months. Meanwhile, the Q1 growth number was revised lower, although only modestly from 6.5% annualised to 6.4% and investors largely overlooked it. There has been very little macroeconomic news of note out of either the UK or Euro Area in the past few days. Probably the main talking point in the UK in the past few trading sessions has been comments from Bank of England ratesetter Vlieghe on Thursday. Vlieghe said that he did not expect the BoE to raise interest rates until deep into next year, although a rate hike could come sooner if the economy were to rebound quicker than expected. Sterling reacted to the latter, jumping by around half a percent versus the US Dollar to trade around the 1.42 level this morning. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.

The Dollar sold-off against its peers on Monday, and then again this morning, as investors continued to calm bets that the Federal Reserve would raise interest rates any time soon. Last month’s much higher-than-expected inflation print got the market questioning whether the Fed would be forced into tightening monetary policy quicker than they had outlined in their latest interest rate projections. Since then, however, FOMC members have continued to strike a dovish tone and insist that the bank would look past a spike in US inflation when making its upcoming policy decisions. Fed policymaker Bullard was the latest such member to calm rate hike expectations on Monday. He noted his view that the increase in US inflation would be mostly temporary and that now was not the time to consider changing monetary policy, so long as the country is still in the midst of a global pandemic. The next few months of data will prove crucial in the timing of the Fed’s next policy move - we expect heightened volatility surrounding upcoming nonfarm payrolls and inflation reports in particular. This afternoon’s US housing and consumer confidence data will not have quite the same impact, but will be closely monitored by investors nonetheless. EUR/USD rises to highest level since January The Pound briefly rallied back above the 1.42 level this morning, although failed to hold onto its gains. Similarly to the US, inflation in the UK is beginning to pick up speed and market participants are looking to the central bank to ascertain whether or not action will be taken to rein in rising prices. Bank of England governor Andrew Bailey appeared unflustered about the prospect of higher prices in his comments on Monday. He stated that he didn’t see any long-term implications from a pick-up in UK inflation and that he’s confident the current policy settings are appropriate. Unlike Sterling, the Euro has managed to hold onto its gains so far this morning and is currently trading around its strongest position since the start of the year. Economic data out of the bloc has turned positive of late, and there is real optimism that a strong rebound is on the cards now that restrictions are beginning to be unwound. IFO sentiment data out this morning was resoundingly strong. The expectations index, for instance, jumped to 102.9 this month from a revised 99.2, its highest level in around two years. There’s no major data out of the Eurozone in the next 24 hours or so, but a speech by ECB member Lane could shift the Euro this afternoon. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.

UK retail sales surged past expectations this morning, although currency traders largely took the data surprise in their stride. As we thought might be the case, sales came in much hotter than expected in April, the first time period that covers the reopening of high street retail outlets. The headline retail sales growth number jumped to 9.2% month-on-month (more than double the 4.5% consensus), with sales also 42.4% higher on a year previous, when the UK was plunged into the first national lockdown. Excluding the volatile fuel component, sales also rose by 9% MoM, the third highest increase on record. Sales of clothing saw a particularly astonishing boom, jumping by 70% on a month previous. Sterling briefly rallied on the back of the news, although the move proved short-lived. We think this largely has to do with investors viewing the consensus of economists’ as a very conservative one that, similarly to the March number, massively underestimated the impact of an easing in lockdown measures on consumer spending. All signs suggest that the UK economy is rebounding very well from the downturn at the beginning of the year and that a strong recovery is on the cards in Q2. This morning’s UK PMI data provided further evidence of just that. The services index fell modestly short of expectations, although still rose to a near 8-year high 61.8, while manufacturing activity boomed to a record 66.1, well above the 60 consensus. With most nations still lagging behind the UK in easing virus restrictions, we see room for further upside in the Pound, particularly should upcoming data continue to point to such a solid rebound in activity. Euro Area PMI data points to solid rebound in Q2 The Dollar was broadly weaker against most of its peers on Thursday as investors continue to look past last week’s strong US inflation numbers. EUR/USD rose back above the 1.22 level, although the pair has found gains hard to come by so far this morning, despite a strong set of Euro Area PMI numbers. Both the services and manufacturing indices beat expectations, pushing the composite index up to 56.9 in May, its highest level since February 2018. With fears over a third wave subsided and the EU’s vaccination programme now in full swing, investors are similarly optimistic that the Euro Area economy is on course to bounce back well in Q2 following its contraction in Q1. The most important barometer for EUR/USD will be whether we begin to see a closing in the gap in economic performance between the US and Eurozone as the latter begins a more material unwinding in lockdown restrictions. This afternoon’s US PMI data will be a major test of this hypothesis. ✒️ Get free weekly chart analysis, FX reports & exchange rate updates. 👉 Avoid FX risk with our tailored solutions. Like👍, Comment💬 & Share📢.